Beware the Age of Uncertainty

The recent past has been full of unpleasant surprises. From the Global Financial Crisis of 2008 to the rise of populist politics and the Covid-19 pandemic, the world doesn’t seem to be a calmly flowing river anymore, if it ever was one. Under these circumstances economic forecasting is a difficult enterprise. Economists and econometricians gauge the future by looking to the past: the models and probability distributions they apply are derived from bygone observations. This may work well in a stationary environment, where political, social, technological, or environmental conditions remain broadly stable, but rather less well when the underlying structure of the economy is shifting in unknown ways. Sudden and unforeseen developments make economic forecasting ever harder.

Economists have reacted to these challenges by turning their attention to uncertainty. This concept, pioneered by Frank Knight in his seminal book Risk, Uncertainty, and Profit (1921), captures the unknowns that economic models treat as exogeneous and that no probability of occurrence can be attached to. At the time of Knight’s writing, the world had just endured World War I, followed by a deadly pandemic (the Spanish Flu), revolutions, the dissolution of empires, and hyperinflation. Uncertainty was everywhere. Individuals, firms, and governments had to cope with an environment of which they did not have “accurate and exhaustive knowledge“, as Knight put it, a notion later economists tended to dismiss.

In recent years, though, “radical uncertainty” (Kay & King 2020) has again become a much-debated issue. Institutions like the World Economic Forum have been publishing risk reports based on experts’ analyses (e.g. World Economic Forum, 2020). Indicators have been constructed to measure uncertainty and to make its economic impacts more predictable, such as the Economic Policy Uncertainty Index (EPU) by Baker, Bloom and Davis (2016). What may sound like a contradiction in itself, makes sense when one assumes that sources of uncertainty may be exogenous to economic models but will show up early in the news reports this type of indicator is built upon. By including journalistic news data into economic analyses, researchers take account of what moves a nation, a valuable exercise since the ups and downs of issue attention can yield real economic consequences.

Our Indicator

In this vein, we constructed a measure we call Uncertainty Perception Indictor (UPI) for Germany. It is based on newspaper articles published in three leading German dailies, Süddeutsche Zeitung, Handelsblatt, and Die Welt, over a period of two decades, from January 2000 to the second quarter of 2020. Currently, the corpus’ size is around 2,9 million articles.

The UPI diverges from the popular EPU in three important aspects: a) it uses a more open query that does not specify certain policy areas ex ante; b) methodologically it is based on a more sophisticated method, the topic modelling approach LDA, that enables us to isolate certain drivers of uncertainty; c) it is based on a more diverse corpus that also includes the slightly left-of-center general newspaper Süddeutsche Zeitung altering the results considerably (Müller & Hornig 2020a, 2020b).

The rationale behind this approach follows from the very nature of uncertainty that in our reasoning comes in three varieties: while market-based uncertainty may also be found in market indicators, such as implied volatility, interest rate spreads or survey data, news content can be expected to capture economic policy uncertainty. Truly exogenous uncertainty, coming from sources outside of both the market and the political system (e.g. climate change, technology shocks, pandemics), can trigger the other two types of uncertainty and may also show up in the news at early stages. Since, by definition, we do not know from which directions the latter type of uncertainty is going to hit ex ante, we broaden the scope in terms of both the query and the corpus.

Three Key Findings

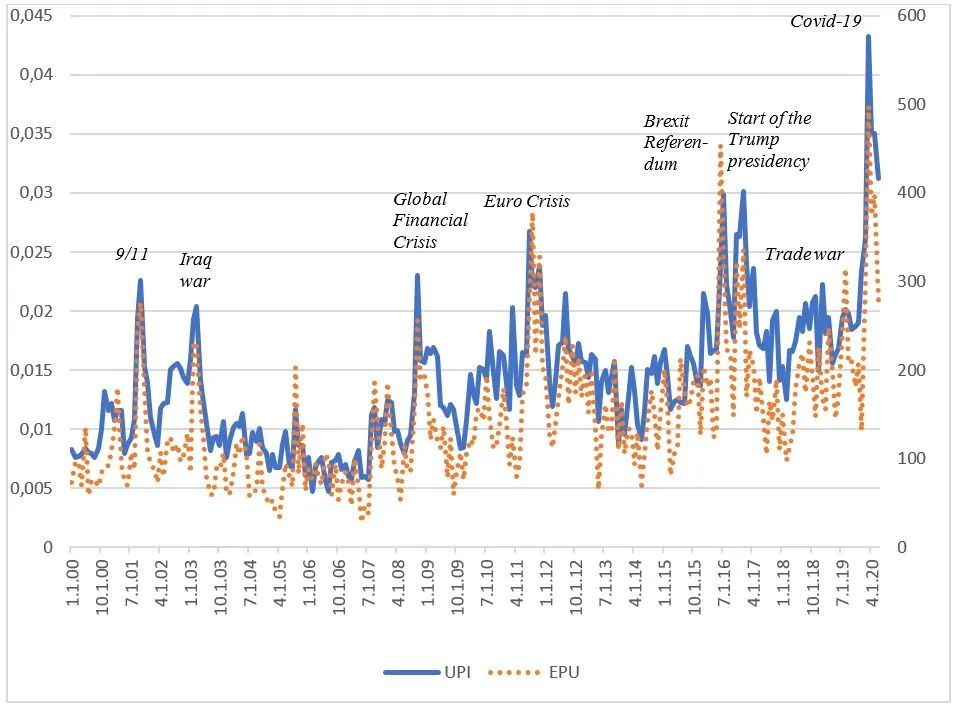

- The Covid pandemic is the biggest uncertainty shock in recent history. As the overall frequency analysis shows (fig. 1), there has been a series of shocks with an increasing amplitude since the Global Financial Crisis (GFC) of 2008. Elevated levels of uncertainty have been the norm ever since. Still, the pandemic induces detrimental effects on economic activity beyond compare.

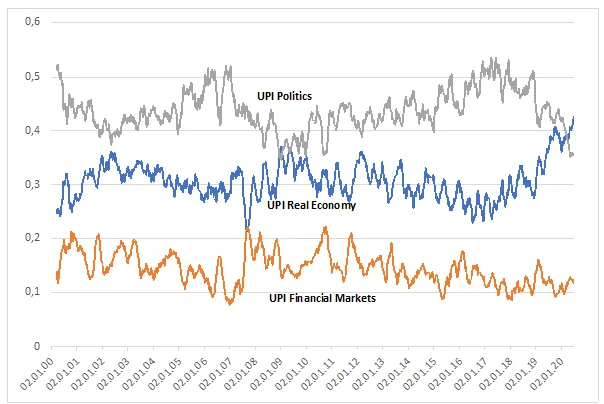

Figure 1: UPI vs. EPU for Germany, Jan 2000 to June 2020 (Source: www.policyuncertainty.com, Müller & Hornig 2020b; left scale: analysis corpus share of entire corpus, right scale: index points; authors’ calculations). - Starting with the Euro crisis, uncertainty shocks were predominantly political in nature (fig. 2). The advent of populist politics has resulted in several severe shocks in the second half of the past decade, with the elevation of Donald Trump to the US presidency and the Brexit referendum, both in 2016, being the most consequential events. At the same time, geopolitical tensions have risen as the once fairly stable world order has been decaying.

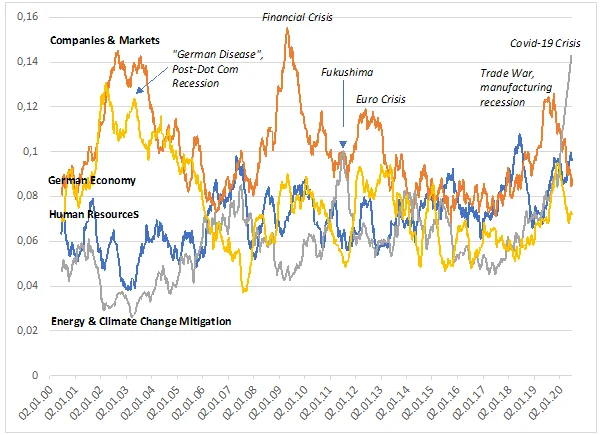

Figure 2: Decomposition of the UPI by Uncertainty Factors* (*shares in analysis corpus; three-month moving averages; source: Müller & Hornig (2020b)) - The Covid-19 crisis constitutes a, in our terminology, truly exogenous uncertainty In the first quarter of 2020, it hit the overall level of perceived uncertainty with full blast. Our methodology sorts the pandemic in the same category as climate change and related issues that are predominantly truly exogenous as well (fig. 3). This blending of issues corresponds with a warning from the Bank for International Settlements, according to which the pandemic could be a harbinger of future “Green Swan events” (Bolton et al., 2020), i.e. major risks whose occurrence is “highly likely or certain” but whose “timing of occurrence and materialization” is uncertain and whose properties are “too complex to fully understand” (da Silva, 2020, p. 6). Green Swans are bound to become more frequent as global warming speeds up and related risks materialize.

Figure 3: UPI Real Economy – individual topics and selected events* (*shares in analysis corpus; three-month moving averages; source: Müller & Hornig (2020b))

A brief conclusion

Our approach sheds light on the nature of economic uncertainty, as it shows up in major newspapers. Drawing from our results, we expect the Covid-19 experience to bring lasting changes to uncertainty perception: while in the past decade or so, economic uncertainty was seen as mainly coming from the realm of politics, with the rise of populism and a less stable global order as the most important developments, the pandemic has led to a re-focusing on more fundamental factors. Put differently, the green narrative about limited natural resources, and catastrophes resulting from their over-use, is supplemented by a new chapter on pandemics. This remarkable change has the potential to feed into the politico-economic system via a host of transmission channels, consequently altering political priorities, relative prices, consumption patterns, or macroeconomic variables. Currently, the landscape of uncertainty perception seems to be shifting in fundamental ways. Economic forecasters should take these considerations into account. Strategists in politics and business would be well-advised to be aware of this transformation when preparing their institutions for the future.

At the current juncture we are confronted with a scenario that in some ways resembles the one Knight faced in 1921. Like him, we come from an extended period of relative calm that contrasts sharply with the new uncertainties we are facing. In his time, memories of the stable, prosperous, and (relatively) peaceful pre-WW I era were still vivid. Before the war, there had been what is now known as the first globalization. During these stable times, stretching from about 1870 to 1914, the notion of ubiquitous uncertainty would have struck contemporaries as overly somber and pessimistic. Yet, in 1921 Knight struck a nerve. And he does again today.

References

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring Economic Policy Uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636. https://doi.org/10.1093/qje/qjw024.

Bolton, P., Despres, M., Pereira da Silva, L. A., Svartzman, R., & Samama, F. (2020). The green swan: Central banking and financial stability in the age of climate change (Bank for International Settlements, Ed.).

da Silva, L. A. P. (2020). Green Swan 2 – Climate change and Covid-19: Reflections on efficiency versus resilience. https://www.bis.org/speeches/sp200514.htm.

Kay, J. & King, M. (2020). Radical Uncertainty. Decision making for an unknowable Future. London, The Bridge Street Press.

Knight, F. H. (1921): Risk, Uncertainty, and Profit. Boston and New York, Hutton Mifflin Company, https://fraser.stlouisfed.org/files/docs/publications/books/risk/riskuncertaintyprofit.pdf.

Müller, H., & Hornig, N. (2020a). Expecting the Unexpected: A new Uncertainty Perception Indicator (UPI) – concept and first results. http://dx.doi.org/10.17877/DE290R-21089.

Müller, H., & Hornig, N. (2020b). „I heard the News today, oh Boy” – An updated Version of our Uncertainty Perception Indicator (UPI) – and some general thoughts on news-based economic indicators. http://dx.doi.org/10.17877/DE290R-21669.

World Economic Forum. (2020). The Global Risks Report 2020. World Economic Forum. http://www3.weforum.org/docs/WEF_Global_Risk_Report_2020.pdf.

Kommentar verfassen